Do you need to apostille your Veterans Affairs – VA letter? Do you need to prove that you are receiving income from the U.S. military (Retirement Pension) so you can live in another country (Example: Philippines)?

Do you need to apostille your Veterans Affairs – VA letter? Do you need to prove that you are receiving income from the U.S. military (Retirement Pension) so you can live in another country (Example: Philippines)?

At Apostille, Inc., we take the guesswork out of obtaining an apostille on your Department of Veterans Affairs certified documents signed by Public Contact Manager at the VA Regional office.

Our trained and knowledgeable staff are available Monday-Saturday from 9am to 6pm to answer your questions and provide you easy to follow step-by-step instructions.

Documents originating from the Veterans Affairs (VA) are processed through the US Department of State in Washington, D.C. Our office in Washington, D.C. will hand delivery and pick-up your documents through the US Department of State in Washington DC. Once complete, we will ship your completed file by UPS or FedEx to the return address indicated on the order form.

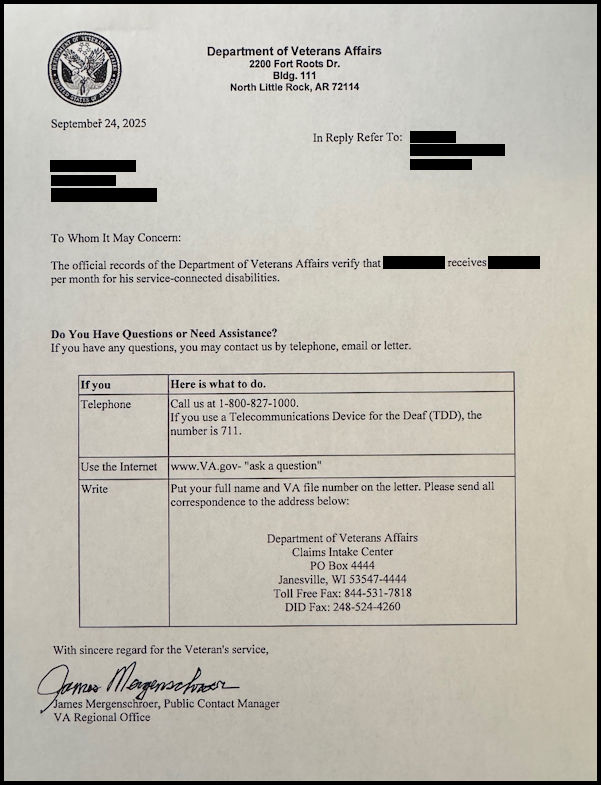

Below is an example of a VA letter issued by the Department of Veterans Affairs:

Free Return Shipping by FedEx or UPS

Office Hours: 8am – 7pm Monday – Saturday

Customer Support: 1-888-810-4054

Email: WashingtonDC@internationalapostille.com

Obtaining an apostille from the US Department of State – Office of Authentications in Washington, D.C. on your Veterans Affairs letter can be complicated and time-consuming. Don’t leave this process to untrained employees or non-professionals who do not fully understand the apostille process and the unique requirements of certain countries. Your paperwork could be rejected costing you time and money. Don’t let this happen to you!

Our staff is available Monday-Saturday from 8am to 7pm to answer your questions and provide you easy to follow-step-by-step instructions. Please call us at 1-888-810-4054.

Click the PDF download image to get started. Our apostille service is fast, convenient, and saves you time and money.

Click the PDF download image to get started. Our apostille service is fast, convenient, and saves you time and money.

Do you need to apostille your documents from the US Department of State in Washington, D.C.?

Do you need to apostille your documents from the US Department of State in Washington, D.C.?

Need to apostille IRS Form 6166 to claim tax benefits in foreign countries? Here’s a comprehensive guide to help you navigate the process smoothly.

Need to apostille IRS Form 6166 to claim tax benefits in foreign countries? Here’s a comprehensive guide to help you navigate the process smoothly. Do you need to apostille your documents through the Secretary of D.C. or the U.S. Department of State – Office of Authentications?

Do you need to apostille your documents through the Secretary of D.C. or the U.S. Department of State – Office of Authentications? Do you need an apostille on a Certificate to Pharmaceutical Product (CPP)?

Do you need an apostille on a Certificate to Pharmaceutical Product (CPP)?